By Tim Stewart

Total superannuation assets reached $2.7 trillion at the end of the June 2018, up 7.9 per cent for the preceding 12 months, according to APRA.

APRA has released its quarterly superannuation performance statistics for the June 2018 quarter, revealing the Australian super sector has grown to $2,709.3 billion.

Total assets in the super sector increased by 7.9 per cent throughout the 12 months to 20 June 2018.

The $2.7 trillion super pool consisted of $631.6 billion in industry funds, $451.9 billion in public sector funds, $622.3 billion in retail funds, $56.1 billion in corporate superannuation, and $749.9 billion in SMSFs.

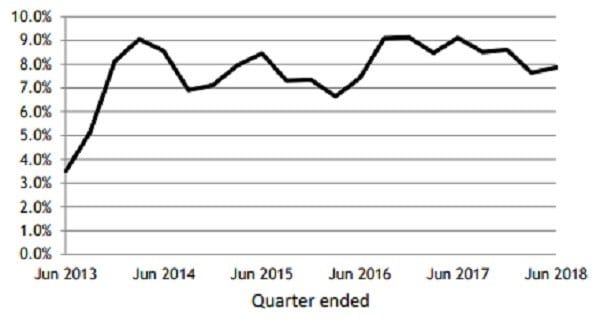

The annual industry-wide rate of return for entities with more than four members (i.e. non-SMSF money, equating to $1.76 trillion) was 7.6 per cent. The five-year average rate of return to June 2018 was 7.9 per cent (see below).

Source: APRA

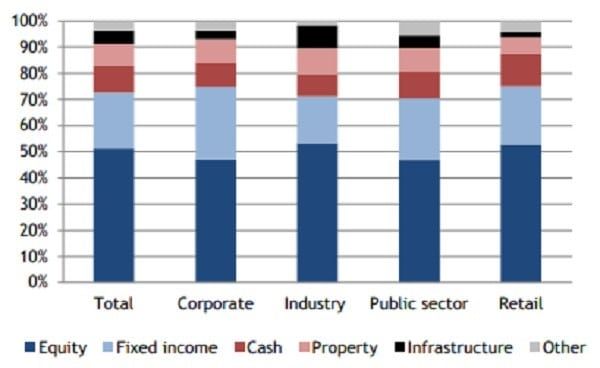

Total assets increased by 3.6 per cent of $65.9 billion over the June 2018 quarter. At the end of the quarter, 51.3 per cent of the $1.7 trillion in non-SMSF money was invested in equities; 31.5 per cent was invested in cash and fixed income; and property and infrastructure accounted for 13.5 per cent.

Asset allocation – June 2018

Source: APRA

Link Wealth Group (ABN 89 051 208 327) is an authorized representative and credit representative of AMP Financial Planning, Australian Financial Services Licensee and Australian Credit Licensee.

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. If you decide to purchase or vary a financial product, your financial adviser, AMPFP, and other companies within the AMP Group may receive fees and other benefits. The fees will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Please contact us if you want more information.