Our financial priorities tend to change as we move through life

Over the past five years, Australians have had greater disposable income and are spending more, while consumer confidence is growing 1

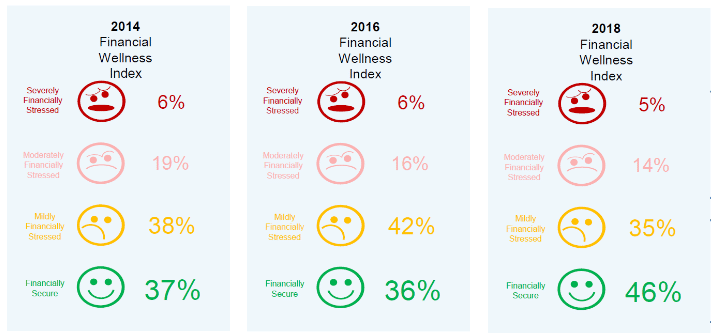

. And in line with these market metrics, AMP’s Financial Wellness Index has shown a marked improvement, with more Australian employees feeling financially secure in 2018 compared with previous surveys.

Source: Financial Wellness in the Australian Workplace, The Behavioural Architects, Report 2018

.

AMP commissioned global insight and research consultancy, The Behavioural Architects, to undertake the research for Financial Wellness in the Australian Workplace. The results were gathered by online interviews with over 2,000 Australian employees. The ensure the research was reflective of employed Australians, the results were post-weighted against data from the Australian Bureau of Statistics (ABS). The Financial Wellness study is conducted by AMP every two years and has been running since 2014.

But AMP’s 2018 Financial Wellness Index shows there are still 2.44 million employed Australians feeling moderately or severely financially stressed. Levels of stress usually depend on where you live, what industry you work in, what family situation you’re in and – not surprisingly – how much you earn. Our 2018 survey results show:

- if you live in Brisbane or Adelaide you’re more likely to be financially stressed than if you live in Sydney or Perth

- if you work in the transport, support services or food service industries you’re more likely to be financially stressed than if you work in mining, IT or public administration

- if you’re part of a single parent family you’re more likely to be financially stressed than other Australians

- and if you earn between $50,000 and $74,999 you’re more likely to be financially stressed than if you earn between $100,000 and $149,999.

But another major factor is your stage of life. Your attitude towards your finances is likely to change as you move through life, from renting to home ownership to property investment, from a new relationship to parenthood to becoming a grandparent, from starting out in your career to holding down a big job to downsizing after years of hard work.

Dealing with financial stress

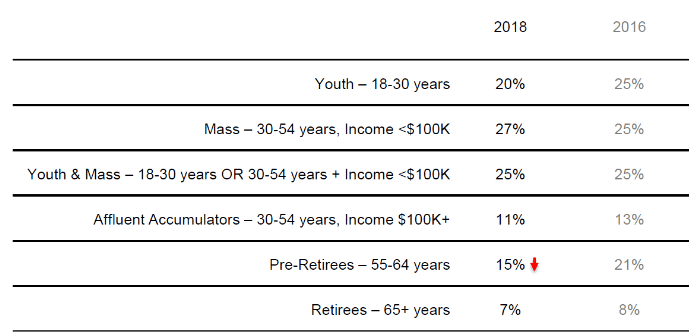

With all the pressure to get established in the world, it’s perhaps surprising the 2018 Financial Wellness Index found only one in five Australians under 30 is financially stressed.

And for most of us, stress levels tend to increase as we get older and our commitments increase, unless we’re lucky enough to be a higher income earner.

Then as we start to approach retirement stress levels tend to decline, as our financial commitments ease off before falling further still in retirement.

Source: Financial Wellness in the Australian Workplace, The Behavioural Architects, Report 2018

The good news from the 2018 Financial Wellness Index is that only 7% of Australian retirees aged 65 or over report being stressed about money. So if you’re feeling the pinch earlier in life there is light at the end of the tunnel. But that’s cold comfort if you’re in the thick of it with the kids, mortgage and bills to pay.

Let’s take a closer look at how your financial wellness is likely to change through your lifetime and what you can do to reduce your stress levels.

Starting out

When you’re starting out in your career, in your relationships and in your adult life, it’s an exciting time. All roads lead open and there are so many possible futures. But with choice can come uncertainty. It’s easy to become paralysed by all the possibilities. Older generations can joke about smashed avocado breakfasts but sometimes it can feel as though it’s never been harder to get established in the world. And as for owning a home…it can feel like an impossible dream. You know you need to start saving for the bigger ticket items but it all seems a bit abstract. Meanwhile you might be on a graduate or apprentice wage and facing peer pressure to spend when you’re out and about. There’s plenty going on socially and that’s where a lot of your disposable income is going. To get on top of your finances it’s a good idea to start with the basics – budgeting, debt and saving. Get those right and you’re well on the way to establishing good habits for life. And these days you can do it all on your mobile.

In the thick of it

There’s no time to draw breath. You’re juggling frantically at home and at work…it’s easy to lose track of what’s going out every week, let alone the bigger financial picture. Any talk about long-term retirement planning can seem unrealistic faced with the day-to-day demands of putting food on the table and the need to pay any school fees and keep up with mortgage repayments. There could be ways to structure your finances to reduce your tax burden and increase your super contributions while still meeting your short-term financial commitments. You’re at a stage of life when planning is critical. And when it comes to money, you’re a bit more savvy these days and starting to think more like an investor than a saver. Are your investments inside and outside super working as hard as possible and do you have the right balance between risk and return for your life stage?

Approaching the finish line

Phew! The end is finally in sight. The kids have flown the coop, the mortgage is either paid off or at least more manageable and your financial commitments are finally starting to diminish. You’re potentially still earning a decent wage but now you have fewer outgoings you might be able to free up some more funds for your super savings. Retirement by now should be front of mind – both in terms of what sort of lifestyle you want to enjoy and how you’re planning to finance it. You can finally see the bigger picture taking shape and it’s important to make the most of these final years in the workforce to set yourself up.

Enjoying the fruits of your hard work

After worrying about money, family and work for so long you’re relishing a simpler life. You’ve worked hard to put all the pieces in place and now it’s time to kick back and enjoy a well-earned retirement. Sure, you’re still concerned about interest rates, retirement income and making provision for health and aged care. And you might be keeping your hand in with some consulting, part-time or voluntary work. But life is simpler and good health permitting there’s more time for the good things in life.

1Financial Wellness in the Australian Workplace, The Behavioural Architects, Report 2018. Intermediary Source: Tradingecomics.com; Primary Sources –ABS, RBA, Westpac.